Indexed Universal Life

Because being wealthy is not just about money— It’s all about freedom.

Understanding Indexed Universal Life (IUL) Insurance

In recent years, Indexed Universal Life (IUL) insurance has attracted both interest and controversy. On one hand, it offers an appealing blend of market-linked growth potential, downside protection, and life insurance coverage. On the other hand, many financial advisors and consumer advocates caution that IULs have gained a poor reputation, largely due to poor structuring, mis‐selling, and a lack of proper preparation by some agents — often with their own commissions in mind. For example, critics point out that exaggerating returns, under-disclosing fees, or presenting unrealistic illustrations have contributed to distrust in the marketplace. Accounting Insights+1

Given the complexity of IULs and the mixed track record in consumer experiences, it’s increasingly important to understand exactly how they work — the dynamics of cash value growth, the flexible premiums and death‐benefit features, the caps/floors on index crediting — and to compare them properly with other permanent life insurance options like Whole Life Insurance and Universal Life Insurance.

The following overview will walk you through the fundamentals of Indexed Universal Life insurance, highlight the strategic “max-funded” IUL approach, and explain how it stacks up against whole life and universal life policies — all to help you make an informed decision aligned with your long-term goals.

💡 What is Indexed Universal Life (IUL) Insurance?

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that provides:

Lifetime coverage (as long as premiums are paid).

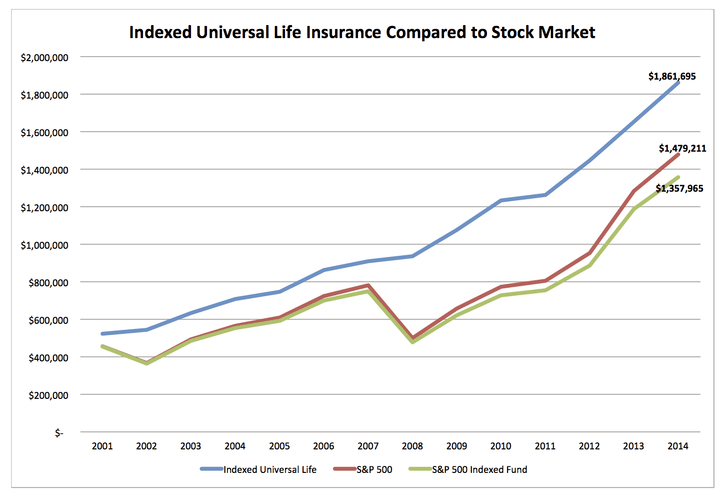

Cash value accumulation linked to the performance of a stock market index (like the S&P 500), without directly investing in the market.

Flexible premiums and death benefits, giving you control over your policy.

Essentially, an IUL combines life insurance protection with potential for tax-deferred growth, tied to market indexes but with downside protection through guaranteed minimum interest rates.

✅ Benefits of an IUL

Growth Potential with Market Indexing

Cash value grows based on an index performance (often capped or floored).

You can potentially earn higher returns than traditional whole life policies without directly investing in the stock market.

Flexible Premiums & Death Benefit

Adjust your premiums and coverage as your financial situation changes.

Can be designed to meet short-term and long-term goals.

Tax Advantages

Cash value grows tax-deferred.

Death benefit is generally income-tax-free to beneficiaries.

Downside Protection

Many IULs have a floor (usually 0%) that protects cash value from negative market returns.

Access to Cash Value

You can borrow or withdraw funds from the cash value for emergencies, retirement, or other financial goals.

⚠️ Drawbacks of an IUL

Complexity

Policies are more complex than term or whole life. Understanding caps, participation rates, and fees is essential.

Costs & Fees

Higher fees than term life insurance.

Cost of insurance, administration fees, and optional riders can reduce cash value growth.

Returns Are Not Guaranteed

While there is a floor, growth is capped. In flat or declining markets, cash value may grow slowly.

Requires Active Management

To maximize benefits, you need to monitor performance and adjust premiums or death benefits carefully.

Max-Funded Indexed Universal Life (IUL): A Smart Strategy for Tax-Advantaged Growth and Retirement Security

When it comes to building wealth while maintaining life insurance protection, many people are turning to Indexed Universal Life (IUL) insurance, particularly the max-funded strategy. This approach combines flexibility, tax-advantaged growth, and downside protection, making it an attractive option for those seeking to supplement retirement income, protect their family, and grow cash value efficiently.

What is a Max-Funded IUL?

A max-funded IUL is an Indexed Universal Life policy funded up to the maximum premium allowed by IRS guidelines without triggering a Modified Endowment Contract (MEC). The goal is to maximize cash value accumulation while retaining life insurance benefits.

Unlike traditional life insurance, where most premiums go toward coverage, max-funding shifts a significant portion into cash value growth, giving policyholders more financial flexibility. According to SmartAsset, this approach “combines life insurance protection with the potential for cash-value growth linked to market indexes.”

How IUL Cash Value Grows

The cash value of an IUL grows based on the performance of a market index, such as the S&P 500, without directly investing in the market. This allows policyholders to participate in market gains while being protected from losses. Most IULs include a floor, often 0%, ensuring that the cash value never decreases during market downturns (Western & Southern).

This structure offers tax-deferred growth, meaning your investments grow without immediate taxation, and, when managed correctly, you can access cash value through loans or withdrawals without triggering income tax (Banking Truths).

Benefits of a Max-Funded IUL

Tax-Advantaged Growth

Cash value in a max-funded IUL grows tax-deferred, and withdrawals or policy loans can be tax-free if structured properly. This makes it an effective way to supplement retirement savings beyond traditional 401(k) or IRA accounts (SafeMoney).Downside Protection

The 0% floor protects your cash value from negative market performance, reducing risk while still allowing for potential upside (Western & Southern).Flexible Access to Cash

Policyholders can access accumulated cash value for financial needs, retirement income, or emergency funds, providing flexibility that most traditional retirement accounts cannot offer (SmartAsset).Supplemental Retirement Income

Max-funded IULs can be structured to provide tax-free supplemental income in retirement, complementing other savings and investment strategies (Capital for Life).Estate Planning Benefits

In addition to growth and retirement advantages, IULs provide a death benefit, which can be used to leave a legacy for heirs while potentially reducing estate taxes (InsuranceAndEstates).

✅ Selected Articles

“What Is Max Funded IUL Insurance?” – SmartAsset

SmartAsset: What Is Max Funded IUL Insurance?

This article explains how a max-funded IUL works, emphasizing tax-advantaged cash value growth and the ability to use the cash value as a supplemental retirement income source. SmartAsset“Max-Funded Indexed Universal Life Insurance (IUL): A Guide” – SafeMoney Blog

SafeMoney Blog: Max-Funded IUL Guide

This guide focuses on the strategy of contributing up to the IRS limit (but not triggering MEC status) in an IUL to maximize cash value. SafeMoney“Max Funded IUL: Tax-Free Growth & Retirement Income Strategy” – Ogletree Financial Blog

Ogletree Financial: Max Funded IUL

This article lays out how a properly structured max-funded IUL can be positioned for tax-free retirement income, while still providing life insurance protection. Ogletree Financial“2025 IUL Guide: How Indexed Universal Life Works” – InsuranceAndEstates.com

InsuranceAndEstates: 2025 IUL Guide

This recent (6 months old) article outlines how IUL policies function, their benefits and potential uses in estate planning and retirement. I&E Strategies“What Is Max-Funded Indexed Universal Life Insurance?” – NASDAQ.com

Nasdaq: What Is Max-Funded IUL Insurance?

A trustworthy publication explaining the concept of max-funded IULs, combining insurance protection with growth opportunity through indexed cash value accumulation. Nasdaq

“This type of insurance policy can be compared to owning an apartment building or running your own business

”

Max-Funded IUL vs. Traditional Retirement Accounts

Some people compare max-funded IULs to 401(k)s or IRAs. While 401(k)s often come with employer matching contributions, they are subject to market risk and required minimum distributions (RMDs). A max-funded IUL offers tax-free loans, downside protection, and flexible cash access, making it a valuable complement to retirement planning (McFie Insurance).

Considerations and Professional Guidance

While max-funded IULs offer compelling benefits, they are not one-size-fits-all. They are typically recommended for individuals who:

Have already maxed out traditional retirement vehicles.

Are seeking tax-diversified growth.

Desire life insurance protection alongside supplemental retirement income.

Proper policy structuring is crucial to avoid MEC status and to optimize tax-free access to cash value. Working with a knowledgeable insurance professional ensures the policy is designed for your long-term financial goals (Ogletree Financial).

Conclusion

A max-funded Indexed Universal Life policy can be a powerful tool for growing wealth, protecting your family, and creating flexible, tax-advantaged retirement income. With downside protection, access to cash value, and estate planning benefits, it stands out as a versatile financial strategy.

For those looking to maximize both growth and protection, exploring a max-funded IUL with a licensed professional could be the key to financial security and long-term legacy building.

Contact us

Let us know if you have any questions or are wanting to see how our strategies can help you secure your financial future!

Info@evergreenwealthandco.com